Frequently Asked Questions

Please read our helpful FAQs for more information on how CIDs work. These have been developed by the City strictly according to legislation detailed in the City Improvement District By-law and Policy.

What is a CID?

A City Improvement District (CID) refers to a clearly defined geographical area, in which property owners contribute additional rates to fund supplementary municipal services for that specific area as per a community supported Business Plan approved by Council. Council determines an area as a special rating area, which then functions as a CID to improve and upgrade the area for an initial 5-year term.

What is the regulatory framework governing CIDs?

CIDs are governed by Section 22 of the Municipal Property Rates Act (MPRA), the Companies Act (Non Profit Company – NPC), the SA Constitution and the City of Cape Town’s City Improvement District By-law of 2023

Why establish a CID?

According to the SA Constitution (Sections 152 & 153), the objective of a local authority is to provide all its residents with certain basic services such as water, electricity, sanitation and refuse removal, etc. – up to an equitable standard. For communities who wish to enjoy municipal services of a higher level, a CID provides them with the option of paying for these additional services, which should be affordable and sustainable.

What types of supplementary municipal services are provided in a CID?

Typically, these would be services dealing with Urban Management issues like additional public safety measures, cleansing services, maintenance of infrastructure, environmental initiatives, and social interventions, etc.

Does the formation of a CID mean that the City can reduce the level and quality of its services?

No. The City is obligated to sustain existing service levels and to provide basic services as per the Constitution. Each CID will engage with the various service departments regarding the level of services provided by the City in their area. This enables the CID to deliver services in addition to what the City delivers.

What are the benefits for property owners in a CID area?

By pooling their resources in a CID, individual property owners can enjoy the collective benefits of a sustainable well- managed area, a shared sense of communal pride, safety and social responsibility, and access to joint initiatives such as waste recycling, energy-efficiency programs, etc. In the end, these all contribute to economic growth and an inflow of capital investments.

Are there different types of CIDs?

Yes, the CID By-law identifies three types of CIDs:

o Business Improvement District (Only owners of business properties pay)

o Mixed-Use Improvement District (Both residential and business property owners pay)

o Residential Improvement District (Only owners of residential properties pay)

How many CIDs are there in Cape Town?

There are currently 51 CIDs in the City of Cape Town. Many other communities have expressed interest in establishing a CID and are at various stages in the establishment process.

How does one establish a CID?

A CID is always initiated by a community, and not by the City.

It usually starts with ‘champions’ within a community who feel the necessity to improve the environment within a defined area. Other like-minded property owners are then approached to form a representative “Steering Committee” to first meet with the CID Branch before officially starting the process. This ensures a better understanding of what a CID is and what is expected from the Steering Committee once the establishment process is started. The next step will be to define the boundary of the proposed CID and consult with the community on what the needs are for the area, and with the local Sub-Council in respect of current City services and level & frequency thereof, before compiling a business plan of how the needs will be addressed.

The draft business plan must then be presented to the community at a public meeting. After the meeting, the community will have 30 days to submit comments to the Steering Committee for consideration. A second public meeting must then be arranged to present the final business plan to the community. A further 30 days must be allowed following the second public meeting for additional comments on the final business plan. Should this lead to a material amendment to the final business plan a third public meeting will be required. Following the consultation process on the business plan the Steering Committee will need to obtain a majority percentage of property owners (over 50% for commercial areas, and at least 60% for areas classified as residential) to agree to the business plan and give written consent or object to the establishment. Each registered property has one available “vote”.

Once the required support has been obtained, the Steering Committee has to submit an application to the City by the 31st of October. After the City has confirmed that the application is valid, the community is notified of the lodging of the application and where the application can be inspected. The application, which includes all the comments and objections, is then submitted to Council for consideration.

What happens after the CID is approved?

After Council has approved the application, a Non-Profit Company (NPC) with members is set up by the Steering Committee who becomes the founding directors of the NPC. Within 6 months of setting up the NPC the first Members` Meeting is held to elect a board of directors. The NPC has to register for VAT, open a bank account and register as a supplier with the City and on the National Treasury Central Supplier Database (CSD). A Finance Agreement must then be concluded between the City and the NPC, which sets out the terms on which payments to the CID is made. This must all be in place before the City makes any payment to the CID. In the first year of operation, the NPC must submit an application to SARS for tax exemption.

What happens when the 5-year term expires?

In the year prior to the term expiry, the CID is required to make application to Council for a further term by submitting a new community supported Business Plan.

Who manages the CID?

A CID is a NPC managed by a board elected by its members, and operated by a management team appointed by the board. The City is not involved in their day-to-day operations, but merely exercises oversight and legal compliance. A Councillor is appointed by the Executive Mayor to attend the CID Board meetings as an Observer facilitating the City’s oversight of the NPC.

Do property owners have a say in a CID?

Yes, all property owners can participate in the affairs of the CID, but only members can vote at Members Meetings (e.g. AGM). Every property owner within the CID should apply in writing to the CID Board for membership of the NPC.

Who can become a Member of the CID?

Property owners liable for the additional rate are not automatic members and can sign up for membership to allow them to vote on the affairs of the CID. Property owners who receive a rates rebate are exempt from the additional rate and cannot apply for membership

Who monitors the finances?

A CID is governed by the Companies Act (71 of 2008), manages its own finances and appoints its own service providers, accountant and auditor. CIDs are required to submit audited financial statements to the City annually for review and presents it at their Annual General Meeting (AGM) for adoption by the members. In addition, monthly financial reports are submitted to the City to monitor and to ensure that expenditure is incurred according to the approved budget. All CIDs have to submit their Annual Report and Annual Financial Statements to the relevant Subcouncil and CID Branch, within three months of their AGM, for noting.

How is a CID funded?

A CID is funded from the additional rates paid by property owners within the boundary of the CID. It does not receive any grants or subsidies from the City, but does have the powers to raise additional income.

How are the CID additional rates calculated?

The CID confirms the properties within the boundaries of the CID, which is linked to the municipal valuations according to the most recent general valuation roll.

The CID annually prepares an overall budget for the year. This is based on the specific needs of the area as set out in the approved Business Plan. Individual contributions are then calculated by dividing the budget total according to the municipal valuations of each property, proportional to the total valuation of the CID.

The CID Policy allows for a differentiation in tariffs for the different types of properties – be it residential, commercial or industrial.

This tariff is then expressed as a rate in the rand and is applicable over a financial year, which starts on 1 July. The CID budget and proposed tariff have to be approved by Council, and advertised for comments and objections as part of the City’s budget process prior to implementation on 1 July.

How does the CID set its budget?

The CID sets its own budget according to input from its members as per the approved five-year Business Plan. Each year, the CID board has to submit a detailed budget to the City by 31 January. The proposed budget may not deviate materially from the approved business plan and must have been approved by the members at the last AGM. If there is a material deviation, an application in terms of Section 26 of the CID By-Law is required. The City evaluates the proposed budget for affordability and sustainability.

How are the CID additional rates collected?

The City collects the additional rates in the same manner as other property rates imposed by Council. The additional rate appears as a separate item (improvement district) on the monthly municipal account of each property owner liable to pay the CID additional rates within the CID.

How does the City resolve additional rates arrears?

Defaulters are subject to the City’s credit control and debt collection policies. As such, they can have their water and electricity services suspended or their clearance certificates withheld.

Is the payment of the additional rates mandatory for all properties within the CID?

Yes. Once Council has approved a CID, the participation of all property owners liable to pay the CID additional rates, within the boundaries of the CID, is mandatory. However, there are exceptions for those property owners who qualify for exemption.

Who can be exempt from paying the CID additional rates?

The following categories of owners / properties will be 100% exempt as per the CID Policy:

• Indigent, Senior Citizens and Disabled Persons who meet the criteria for rates relief

• Council owned properties used predominantly for official municipal business

• Properties owned by an organisation – not for profit and used as an early childhood development facility

• Properties owned by an organisation – not for profit and used for youth development

• Properties owned by an organisation – not for profit and used as accommodation for the vulnerable

• Properties owned by an organisation – not for profit and used for an old age home

• Properties owned by an organisation – not for profit and used exclusively for amateur sport

• Properties owned by a Social Housing Regulatory Authority accredited Social Housing Institution and used for social housing

• Properties owned by war veterans’ associations and used for the welfare of war veterans

• Properties owned by public benefit organisations and used for specified public benefit activities

• Properties owned by a religious community and used for specified religious purposes

• Cemeteries and Crematoria

• Properties owned by an organisation – not for profit and used for animal shelters

• Properties owned by an organisation – not for profit and used as a local community museum

• Nature conservation land

What if the valuation base changes within a financial year?

The valuation base is a snapshot at a point in time (end February) and is used to calculate the additional rate (rate in the rand) for the following financial year. However, municipal valuations can change within a financial year due to supplementary valuations, Valuation Court rulings, sub-divisions, rezoning or other technical adjustments. Should the valuation base decrease or increase substantially, the City must inform the CID in order to assess the potential impact on the CID’s additional rate and/or budget.

Can my CID additional rates be spent anywhere in the City?

No, it is ring-fenced to be ploughed back exclusively into the CID.

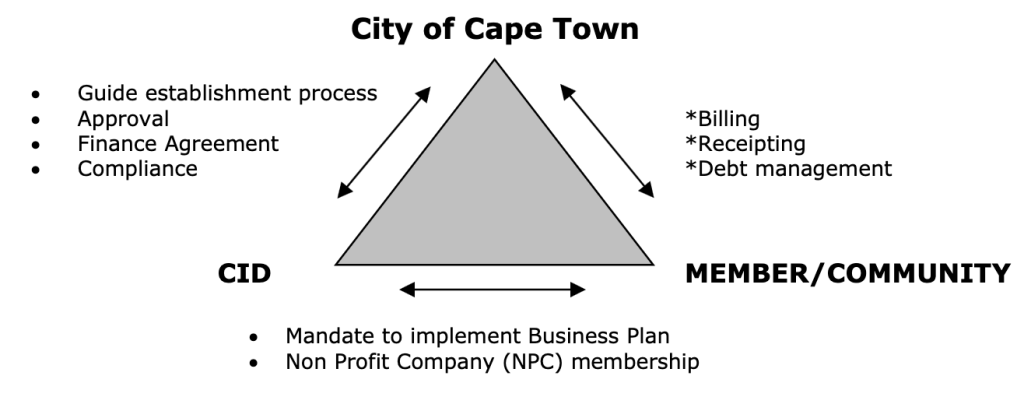

What is the relationship between the City, CID and member/community?